Here’s another interesting piece from the NYT. Van Zeck is America’s Mr. IOU man. At a time when the US government is issuing record amount of debt to finance its programs, Zeck sure is a busy, busy man. His story is one that is completely under the radar. While everyone focuses on stocks rallying, volatility gyrating, and the bond yields swing opposite the stocks’ direction, only the analysts and traders find themselves on the limelight. The Treasury auctions, whose number has increased a couple of times this year, surely create a buzz but nobody thinks about the man behind the operations.

The New York Times introduces us to the man who oversees Treasury auction:

In a city full of pompous politicians and bombastic bureaucrats, Mr. Zeck quietly runs one of the government’s truly indispensable operations. He is not a policy maker. He does not decide how much to borrow. He just makes sure the money is borrowed, in a regular and predictable way, at the lowest possible cost to the government over time.

“We are the back office, the plumbing,” Mr. Zeck said. “We are borrowing a ton of money. It has to be done right.”

A little about the changes auctions have seen just this year as a result of increasing demand to borrow debt:

In February, the Treasury announced it was bringing back the seven-year note, for the first time since 1993, and it doubled the number of 30-year bond auctions, to eight a year. Just three months later, it announced a further increase in the frequency of 30-year bond auctions, to 12 a year.

On Aug. 5, the Treasury told investors they “should expect auction sizes to continue to rise in a gradual manner over the medium term.”

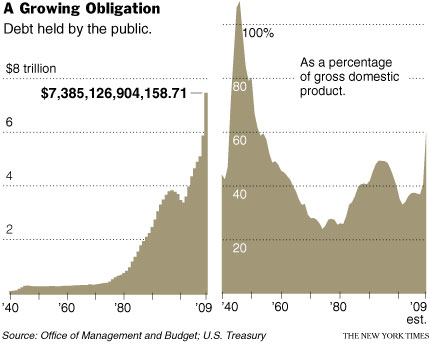

See the full story here… and the supporting chart re: to the country’s growing debt: